Turbulence at Tata Sons: What stakeholders are asking

Tata Sons, while not listed, sits at the apex of the largest business group in India. It enjoys a stellar reputation and is considered...

Nurturing corporate culture

How often does the board discuss company culture? The Wells Fargo and the Volkswagen incidents highlight the importance of – or rather,...

Arundhati Bhattacharya’s unfinished agenda at SBI

The State Bank of India (SBI) is modernizing itself. It is leveraging technology, improving the quality of disclosures in its annual...

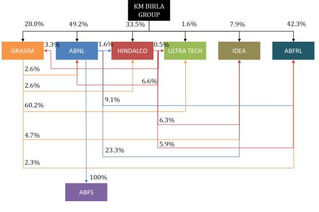

Aditya Birla Financial Services – will it benefit from being a Grasim subsidiary?

The Aditya Birla group contends that housing the Aditya Birla group’s financial services business within Grasim will help it leverage a...

Dividends: SEBI mandates a policy

On 8 July 2016, SEBI amended the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2016, to make it mandatory for the...

Rethinking the Boards Stakeholder Relationship Committee

In this digital era when shares are dematerialized and do not have the pain associated with the transfer of physical shares, and when...

Listing of L&T’s subsidiaries: Management creates its own ‘options’

L&T’s executive directors have been opportunistic – they have generously issued themselves stock options at face value from subsidiaries...

Companies and investors make corporate governance a common cause

The ‘Common-sense corporate governance principles,’ signed-off by 13 CEO’s led by Jamie Dimon of JP Morgan Chase, provides practitioners...

Grasim-ABNL Merger: That 70’s show

On 12 August 2016, the Aditya Birla Group announced the merger of its two holding companies, Aditya Birla Nuvo Limited (ABNL) and Grasim...

BOARD EVALUATION IN INDIA: DISCLOSURES AND PRACTICES

The board of directors as you know, are responsible for a company’s corporate governance levels. This is also why any measure of...